What is health Insurance?

Health insurance is a type of insurance coverage that pays for medical, surgical expenses incurred by the insured. Health insurance can reimburse the insured for expenses incurred from illness or injury or pay the care provider directly.

Why is health insurance important?

Today, quality healthcare treatment is expensive. A decent hospital has the potential to finish up your savings in a few days. A health insurance policy protects you and your family. Today, several companies offer health insurance plans to their customers that provide various benefits such as cashless treatment at network hospitals, tax benefit etc.

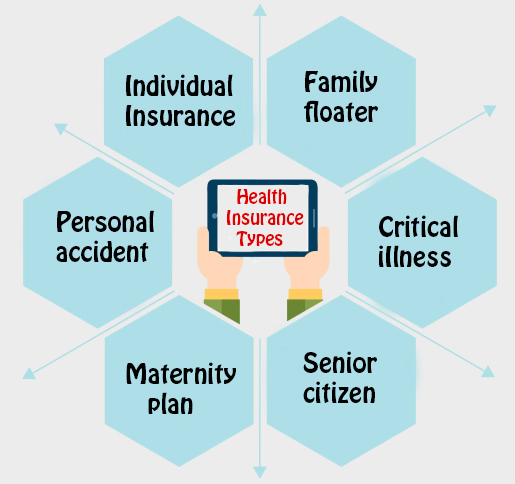

Types of Health insurance

1.Individual Insurance

Under an individual health insurance plan, a single person is covered for the chosen sum insured.

2.Family floater health insurance

A family floater mediclaim policy makes sense because each member gets a big cover.

3.Critical illness

The Policyholder will be liable to receive a fixed benefit payout in case any critical illnesses specified under the policy.

4.Senior citizen

The plan is designed especially for yje old age people, particularly the age above 60 years.

5.Maternity plan

It provide cover to all your maternity expenses.

6.Personal Accident

A personal accident plan insurance that provides policyholders with financial support in the event of an unfortunate accident.